Creality K1 SE 3D Printer, 2024 New Version 600mm/s High-Speed Hands-Free Auto Leveling Flagship-Level Direct Extruder Quick-swap Tri-Metal Nozzle K1 Upgrade 3D Printer

$279.00 (as of June 19, 2025 23:45 GMT +00:00 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Nano Dimension, an Israeli electronics 3D printer manufacturer, has announced its acquisition of Desktop Metal, a Massachusetts-based company, in an all-cash deal valued at approximately $183 million. This strategic move, which is expected to close in the fourth quarter of 2024 pending regulatory and stockholder approvals, represents a significant 27.3% premium on Desktop Metal’s closing price as of early July 2024. Under the leadership of Nano Dimension CEO Yoav Stern, who will continue as CEO of the new entity, and Desktop Metal CEO Ric Fulop joining the C-suite and board, the combined company aims to revolutionize mass manufacturing applications in 3D printing. By drawing on an extensive patent portfolio and targeting high-growth industries, the merger seeks to establish a leading position in industrial 3D printing, despite some shareholder concerns and a projected transition period of negative cash flow. Have you heard about the latest news in the 3D printing world? There’s a buzz going around about Nano Dimension’s recent announcement to acquire Desktop Metal. This move is set to shake up the industry, and if you’re into innovative technology and business strategies, you’ll definitely want to dive into the details.

$30 off $400+ Anycubic Products with code AC30OFF

Acquisition Announcement

Nano Dimension, a leading Israeli electronics 3D printer manufacturer, has made headlines with its intention to acquire Massachusetts-based Desktop Metal in an all-cash deal valued at approximately $183 million. This merger isn’t just a blip on the radar; it’s a significant event that’s poised to have wide-reaching implications for the 3D printing and digital manufacturing sectors.

Deal Details

So, what are the specifics of this deal? Let’s break it down.

Transaction Value

The transaction is valued at $5.50 per share, potentially reducible to $4.07 per share due to various costs and contributing factors. This valuation represents a 27.3% premium on Desktop Metal’s closing price and a 20.5% premium to the 30-day Volume Weighted Average Price (VWAP) as of July 2, 2024.

Closing Timeline

The expected closure for this deal is set for Q4 2024, contingent on receiving regulatory approvals and the green light from Desktop Metal’s stockholders. So, we’re looking at a bit of a waiting game, but the wheels are certainly in motion.

Leadership Changes

Yoav Stern, the current CEO of Nano Dimension, will assume the CEO role in the newly formed entity post-acquisition. Meanwhile, Desktop Metal’s CEO, Ric Fulop, is set to join the C-suite and the board, fostering a blend of leadership expertise from both companies.

Buy Photon Mono M5 Get Free 1KG Resin

Financial Position

When it comes to financial health, the combined company appears solid. The joint revenue for FY’23 stands at an impressive $246 million, with 28% of that being recurring revenue. This kind of financial backdrop can provide a stable launching pad for future growth and innovation.

Projected Revenue

| Financial Metric | Value |

|---|---|

| Joint FY’23 Revenue | $246 million |

| Recurring Revenue | 28% |

A strong financial position like this not only emboldens strategic decisions but also provides the confidence for future investments, particularly in high-growth industries.

Strategic Intent

The merger aims to propel the combined entity to the forefront of mass manufacturing applications in 3D printing. Here’s a closer look at their strategic aims:

Digital Manufacturing Focus

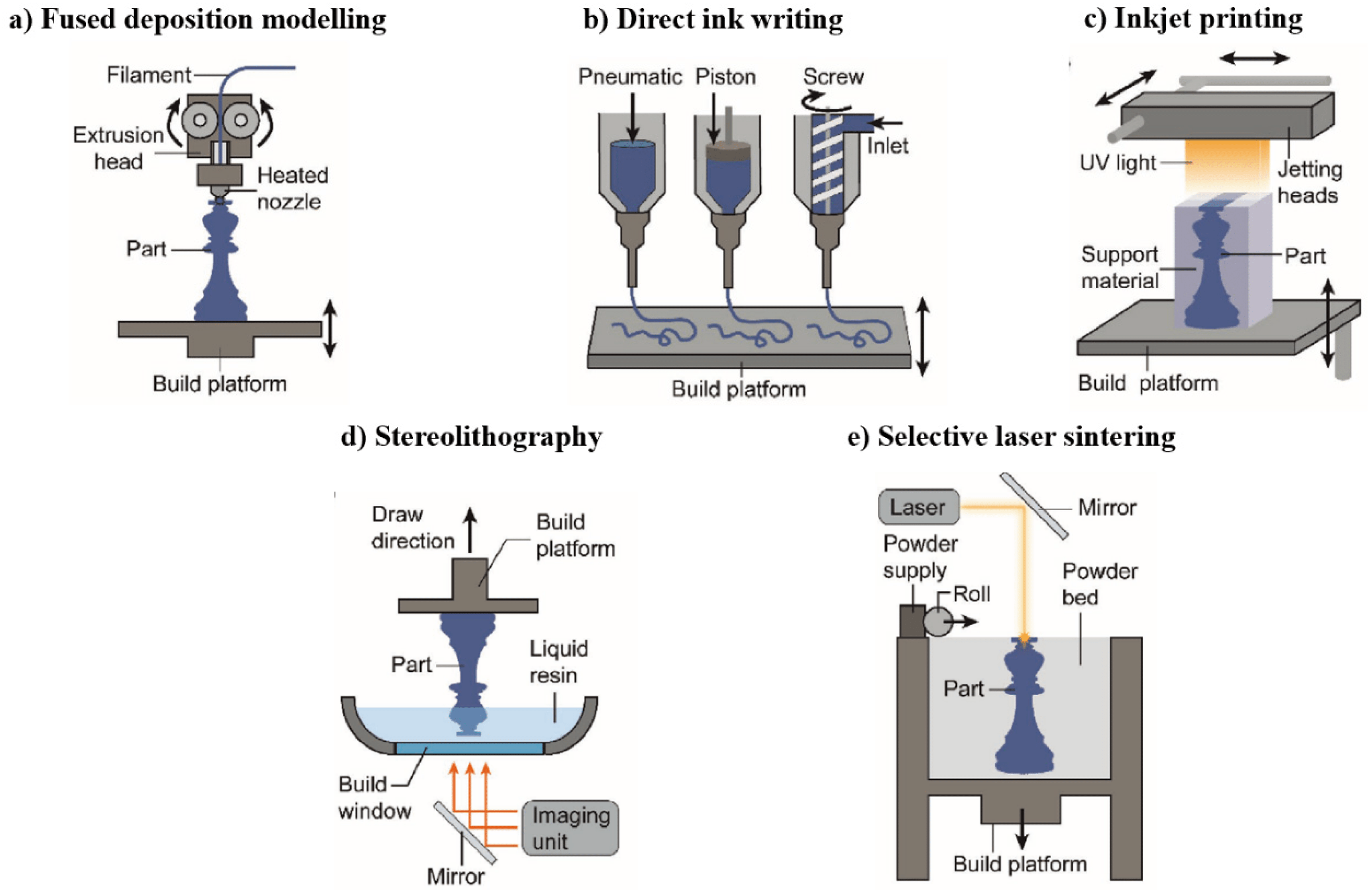

The focus will span several areas within digital manufacturing, making for a pretty comprehensive portfolio. This includes:

- Metal

- Electronics

- Casting

- Polymer

- Micro-Polymer

- Ceramics

Patent Portfolio

The new entity will gain access to an extensive patent portfolio, boasting over 1,000 combined patents. This strong intellectual property position could significantly benefit the company in terms of innovation and market positioning.

Target Industries

The merged company is targeting several high-growth arenas, including:

- Automotive

- Aerospace

- Defense

- Industrial

- Medical

- Research & Development / Academia

This cross-industry approach can help to diversify risk and open new streams of revenue, setting the stage for long-term success.

Shareholder Concerns

With big moves come big reactions, and some Desktop Metal shareholders have voiced their dissatisfaction. Key concerns revolve around the terms of the deal, especially considering the historically low trading values of Desktop Metal and other potential transaction costs. While these concerns are valid, it’s essential to weigh them against the strategic benefits that this merger could bring about.

Future Prospects

What does the future hold for this new powerhouse in the 3D printing world? Let’s gaze into the crystal ball.

Leveraging Combined Customer Base

Both companies plan to capitalize on their combined customer bases and cross-sell opportunities. This can provide lots of room for growth, allowing both firms to offer more comprehensive solutions to existing clients while attracting new ones.

Employee Headcount

Current plans indicate there won’t be an immediate reduction in employee headcount. However, as with many mergers, there is the possibility of future mergers and acquisitions, which could change the dynamic down the line.

Path to Profitability

Yoav Stern has emphasized a clear roadmap to profitability, albeit acknowledging a transitional period of 6-8 quarters of negative cash flow. This upfront transparency can help set realistic expectations as the newly formed entity finds its footing.

Potential Market Impact

Can this merger position the new company as a formidable competitor in the industrial 3D printing market? Absolutely.

Comprehensive Digital Manufacturing Solutions

By bringing together Nano Dimension and Desktop Metal’s unique strengths, the new company aims to provide a wide range of digital manufacturing solutions. This positions them well in the Industry 4.0 landscape, where innovation and comprehensive service offerings are key.

Leading Innovation

With a blend of established technologies and forward-thinking strategies, the merged entity is set to lead the charge in innovation. This could spur advancements not just within their own operations, but across the entire 3D printing and digital manufacturing industries.

Competitive Edge

Combining their resources, technologies, and intellectual property can give the new company a competitive edge. By offering more integrated and advanced solutions, they can better meet the needs of high-growth industries and set new benchmarks in the market.

Conclusion

So, there you have it—a detailed look at Nano Dimension’s acquisition of Desktop Metal. This is more than just a business deal; it’s a union that holds vast potential to reshape digital manufacturing as we know it. Whether you’re a shareholder, an industry professional, or simply someone who loves keeping up with cutting-edge technology, this merger is something to watch closely. It promises innovation, growth, and a new era in 3D printing and beyond.

$30 off $400+ Anycubic Products with code AC30OFF