Anycubic Kobra S1 Combo 3D Printer, Multi-Color 3D Printer High Speed Max 600mm/s High Precision, Core XY Stable Structure Ultra-Quiet Printing Anycubic App One-Click Printing 250 * 250 * 250mm

$599.99 (as of June 21, 2025 23:57 GMT +00:00 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Have you ever wondered what happens when a company’s market capitalization falls below the threshold required for it to remain listed on a major stock exchange?

NYSE Delists Velo3D Securities as Market Cap Falls Short

The New York Stock Exchange (NYSE) has decided to delist the securities of Velo3D, a prominent metal 3D printing company, due to its failure to meet the continued listing standards. This decision marks a significant development for the company, which primarily serves the defense and aerospace industries. In this article, we will delve into the details of this delisting, what it implies for Velo3D, and the broader implications for similar companies.

$30 off $400+ Anycubic Products with code AC30OFF

Background on Velo3D

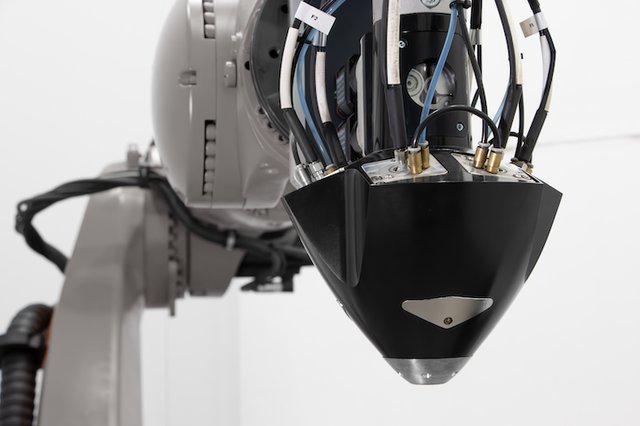

Velo3D has been a significant player in the 3D metal printing industry, offering cutting-edge technology primarily aimed at the defense and aerospace markets. Founded with a vision to transform manufacturing processes, Velo3D has been instrumental in enabling the production of complex metal parts that were previously difficult or impossible to achieve with traditional manufacturing techniques.

NYSE Listing Requirements

Before diving deeper into the implications of the delisting, let’s first understand the NYSE’s listing requirements. The NYSE mandates that publicly traded companies maintain specific standards to remain listed on the exchange. One of these standards is maintaining an average global market capitalization of at least $15,000,000 over a consecutive 30 trading day period. This requirement aims to ensure that listed companies have a significant market presence and investor interest.

Buy Photon Mono M5 Get Free 1KG Resin

The Delisting Decision

On September 11, 2024, NYSE Regulation announced their decision to commence proceedings to delist Velo3D’s securities. This decision came after Velo3D failed to meet the required market capitalization threshold, an issue that had been persisting over a consecutive 30 trading day period. Consequently, trading of Velo3D’s securities, including VLD (common stock, par value $0.00001 per share) and VLD WS (warrants to purchase one share of common stock at an exercise price of $402.50 per share), was suspended immediately.

Legal Basis for the Delisting

The delisting of Velo3D’s securities is in accordance with Section 802.01B of the NYSE’s Listed Company Manual. This section specifically addresses the listing standards companies need to adhere to and provides a structured mechanism for delisting companies that fail to meet these standards. The initiation of the delisting process underscores the seriousness with which NYSE takes these regulations, ensuring that investors are offered securities that meet their established financial criteria.

Company’s Right to Appeal

Despite the initiation of delisting proceedings, Velo3D has the right to request a review of this determination. This review would be conducted by a Committee of the Board of Directors of the Exchange. During this review process, Velo3D can present its case, potentially offering reasons or future outlooks that might convince the committee to reconsider the delisting decision.

Implications for Investors

The immediate suspension and potential delisting of Velo3D’s securities have significant implications for investors. Firstly, the suspension of trading means investors holding Velo3D’s securities may face liquidity issues, as they cannot trade their shares on the NYSE. This move also signals risks associated with holding Velo3D’s shares, potentially affecting investor confidence and the stock’s market price.

| Aspect | Details |

|---|---|

| Trading Suspended | Immediate suspension of both VLD and VLD WS securities, affecting liquidity. |

| Investor Confidence | Potential decrease in investor confidence due to delisting announcement. |

| Market Price | Likely to be impacted negatively, potentially resulting in loss of shareholder value. |

Velo3D’s Future Prospects

While the current scenario appears challenging for Velo3D, it is essential to consider the company’s future prospects. Velo3D has been a technological leader in its field, and its innovations continue to offer significant value to its target markets. However, to regain investor confidence and potentially appeal the NYSE’s decision, the company may need to implement strategic measures to improve its market capitalization and overall financial health.

Impact on the 3D Printing Market

The delisting of Velo3D’s securities reflects broader market dynamics and investor sentiment within the 3D printing industry. The 3D printing sector, while innovative, is still maturing, and companies within this space need to demonstrate robust financial performance to gain and retain investor trust. Velo3D’s challenges highlight the importance for companies in this industry to balance technological advancements with solid financial management.

Broader Industry Implications

The news of Velo3D’s delisting can be a cautionary tale for other companies in the additive manufacturing space. As the industry evolves, maintaining transparency, strong financials, and adhering to market regulations becomes crucial. This event may prompt other companies to reassess their financial strategies and market visibility to avoid facing similar challenges.

What Could Have Been Done Differently?

One can speculate what Velo3D could have done differently to avoid this situation. Possible actions might include more aggressive marketing strategies, strategic partnerships, or financial restructuring to boost market capitalization. Effectively communicating their value proposition to investors and stakeholders could also have played a crucial role.

Future of Velo3D in Secondary Markets

Should Velo3D be fully delisted from the NYSE, it might seek to trade on secondary markets or over-the-counter (OTC) platforms. While these markets are less regulated, they offer companies an alternative venue to continue trading their securities and maintain some degree of market presence. However, companies trading on these platforms often face challenges such as lower liquidity and investor confidence.

Comparisons to Other Similar Cases

Velo3D is not the first nor the last company to face delisting due to a shortfall in market capitalization. Comparing this case to other similar instances can provide additional insights. For instance, companies in other high-tech or niche markets often face significant volatility, impacting their market capitalization. Learning from these cases can provide valuable lessons for Velo3D and similar companies.

Steps for Affected Stakeholders

For investors and other stakeholders affected by Velo3D’s delisting, it is crucial to understand the steps they can take next. Consulting with financial advisors, staying informed about further developments concerning Velo3D’s appeal, and exploring alternative investment options are practical steps to consider.

Industry Perspectives

Industry experts and analysts provide diverse perspectives on Velo3D’s situation. Some might view this as a temporary setback that Velo3D can overcome with the right strategies, while others may see it as an indication of more profound challenges within the company. These varied viewpoints enrich the discussion about the future of Velo3D and the 3D printing industry at large.

Conclusion

The NYSE’s decision to delist Velo3D’s securities underscores the critical importance of meeting established financial standards for continued listing on major stock exchanges. For Velo3D, this development marks a significant moment that will likely necessitate strategic reassessment and action to address market capitalization concerns and regain investor confidence. This delisting also serves as a broader reminder to other companies in the additive manufacturing industry about the importance of balancing innovation with sound financial management.

Further Reading and Resources

For those interested in deeper insights and continued updates on Velo3D and the additive manufacturing industry, consider following relevant industry news outlets, joining professional communities on platforms like LinkedIn, and exploring comprehensive market studies. Staying informed empowers stakeholders to make well-considered decisions in a rapidly evolving market landscape.

The narrative of Velo3D’s delisting serves not only as a point of interest but also as a case study highlighting the critical nature of financial robustness in high-tech markets. Readers are encouraged to reflect on these insights and consider their implications within the broader context of market dynamics and company performance.

$30 off $400+ Anycubic Products with code AC30OFF