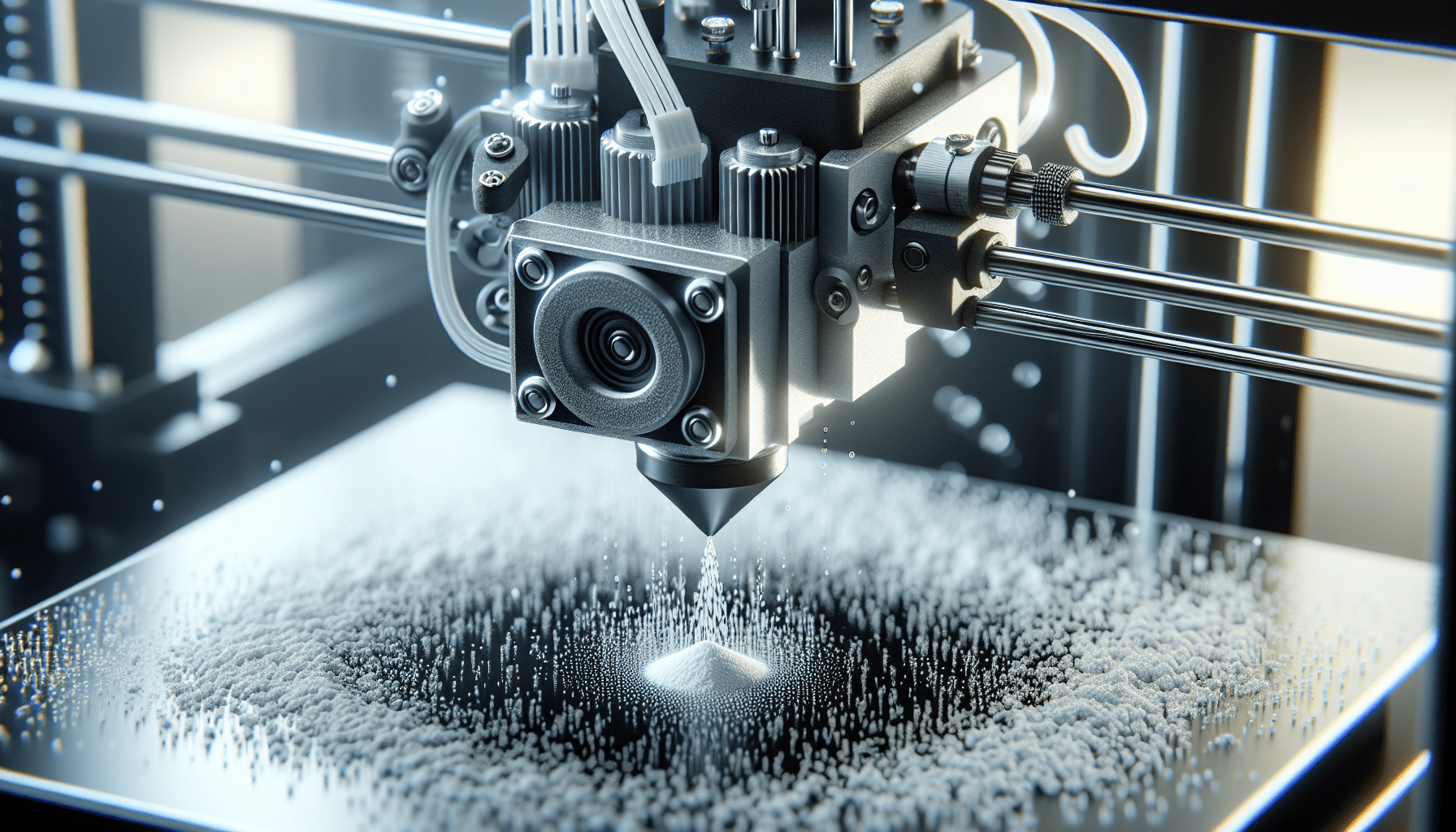

Sovol SV08 Core-XY 3D Printer Voron 2.4 Open Source, 700mm/s High Speed 3D Printers with 300℃ Clog-Free Hotend & Camera, Auto Leveling with 4 Independent Z Motors, Large Print Size 13.8x13.8x13.6in

$699.99 (as of June 19, 2025 23:45 GMT +00:00 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)You’re about to dive into the tumultuous journey of Shapeways, a renowned 3D printing service provider now facing bankruptcy. After rejecting a lifeline in the form of a $5 million rescue bid, Shapeways found themselves grappling with severe operational and liquidity challenges. Failing to meet optimistic financial projections post-SPAC deal and struggling with a steep decline in stock price, they sought relief through various strategic actions, including workforce cuts. Despite these efforts, Shapeways filed for Chapter 7 bankruptcy on July 2, 2024, leading to the cessation of operations and the resignation of its executive team. In a heartening twist, the resilient staff at the Eindhoven facility have shown remarkable solidarity, striving to restart the business independently. Have you ever wondered what happens when a company rejects a rescue bid and faces the dire consequences of bankruptcy? Today, we’re delving into the story of Shapeways, a once-promising 3D printing service provider, that found itself in a precarious financial position. After rejecting a $5 million rescue bid, Shapeways faced a series of operational challenges and financial turmoil, ultimately leading to its bankruptcy.

$30 off $400+ Anycubic Products with code AC30OFF

Shapeways Bankruptcy

Shapeways, a renowned 3D printing service provider, recently found itself on the brink of financial collapse. Despite its innovative contributions to the tech world, it faced bankruptcy after rejecting a $5 million rescue bid. This decision marked the beginning of a tumultuous period for the company, characterized by operational challenges, financial turmoil, and eventual cessation of operations.

Rejecting the Rescue Bid

Shapeways’ decision to reject the $5 million rescue bid puzzled many. The bid could have provided a lifeline, allowing the company to continue operations while addressing its financial difficulties. However, the refusal indicated that Shapeways might have had alternative plans or believed the bid undervalued its potential.

Operational Challenges

One of the significant challenges Shapeways faced was its inability to timely file its quarterly report due to resource constraints and ongoing strategic evaluations. This delay not only reflected operational inefficiencies but also raised concerns among investors and stakeholders about the company’s financial health and management capabilities.

Resource Constraints

Resource constraints became a critical issue for Shapeways. The company struggled to allocate adequate resources to its accounting and finance departments, leading to delays in financial reporting. This, in turn, affected its ability to make informed strategic decisions and maintain stakeholder confidence.

Strategic Evaluations

In an attempt to navigate its financial difficulties, Shapeways engaged in ongoing strategic evaluations. These evaluations aimed to identify potential solutions, such as cost reduction initiatives and strategic partnerships. However, the prolonged evaluation period further strained the company’s operations and contributed to its downward spiral.

Buy Photon Mono M5 Get Free 1KG Resin

Financial Turmoil

Shapeways’ financial performance post-SPAC deal fell significantly short of its optimistic projections. The company experienced notable revenue shortfalls and a substantial decline in its stock price, indicating a deeper financial crisis than initially anticipated.

Post-SPAC Deal Performance

The Special Purpose Acquisition Company (SPAC) deal was expected to bolster Shapeways’ financial position and drive growth. However, the reality was starkly different. The company’s revenue fell short of expectations, and the anticipated growth failed to materialize, putting additional pressure on its financial stability.

Revenue Shortfalls

Revenue shortfalls were a significant indicator of Shapeways’ financial turmoil. The company’s inability to generate the expected revenue raised red flags among investors and stakeholders. This shortfall also impacted its capacity to invest in necessary operational improvements and strategic initiatives.

Stock Price Decline

The financial uncertainty surrounding Shapeways led to a substantial decline in its stock price. Investors’ confidence waned, and the falling stock price became a visible manifestation of the company’s deepening financial woes. This decline further limited Shapeways’ ability to attract new investments and secure funding.

Strategic Actions

In an effort to mitigate its financial distress, Shapeways pursued various strategic options. These included auctions, cost-reduction initiatives, and workforce cuts. Despite these measures, the company couldn’t overcome its financial challenges.

Auction Efforts

Shapeways attempted to generate liquidity through auctions, selling off assets and seeking potential buyers for parts of its business. However, these efforts did not yield sufficient funds to stabilize the company.

Cost-Reduction Initiatives

Cost-reduction became a priority as Shapeways aimed to streamline operations and reduce expenses. The company implemented various measures, including cutting non-essential expenditures and optimizing resource allocation.

Workforce Cuts

Unfortunately, the financial pressure led Shapeways to make difficult decisions regarding its workforce. Layoffs were implemented as a necessary step to manage costs, but these cuts also affected the company’s operational capacity and morale.

Bankruptcy Filing

On July 2, 2024, Shapeways filed for Chapter 7 bankruptcy, ceasing its operations and marking a definitive end to its business journey. The company’s executive team resigned, signaling a complete organizational shutdown.

Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy meant that Shapeways intended to liquidate its assets to pay off creditors. This type of bankruptcy indicated that the company saw no viable path to continue its business operations or restructure its debts.

Ceasing Operations

The bankruptcy filing led to the immediate cessation of Shapeways’ operations. This abrupt end affected not only the company’s employees but also its clients and partners who depended on its services.

Executive Team Resignation

The resignation of Shapeways’ executive team underscored the gravity of the situation. The leadership’s departure left the company without strategic direction during its most challenging period, complicating efforts to manage the fallout of the bankruptcy.

Team’s Response

Despite the overwhelming challenges, the staff at the Eindhoven facility demonstrated remarkable solidarity. They aimed to restart the business independently, showing resilience and a commitment to their work.

Eindhoven Facility Response

At the Eindhoven facility, employees rallied together to explore possibilities of continuing the 3D printing services independently. Their determination to carry on the work highlighted the strong sense of community and dedication within the team.

Independent Business Restart

The independent restart effort involved seeking new funding sources, establishing a new business entity, and leveraging the expertise and experience of the former Shapeways team. This initiative represented a glimmer of hope amid the company’s broader struggles.

SEC Filing

A regulatory filing with the Securities and Exchange Commission (SEC) confirmed these developments and provided a detailed outline of the events leading to Shapeways’ bankruptcy. This filing was crucial for transparency and accountability.

Importance of Regulatory Filing

Regulatory filings are essential for maintaining transparency and keeping stakeholders informed. Shapeways’ filing with the SEC provided an official account of its financial troubles and the steps taken leading up to the bankruptcy.

Events Outline

The SEC filing detailed the timeline of events, including the rejection of the rescue bid, operational challenges, financial performance issues, strategic actions, and the eventual bankruptcy filing. This comprehensive outline offered a clear picture of Shapeways’ journey from financial distress to liquidation.

Table: Shapeways Key Events Timeline

To provide a clearer understanding of the sequence of events, the table below summarizes the key milestones in Shapeways’ path to bankruptcy:

| Date | Event |

|---|---|

| Pre-2024 | Initial operational challenges |

| 2023 | Post-SPAC deal financial performance shortfalls |

| Early 2024 | Continued strategic evaluations and resource constraints |

| Mid-2024 | Rejection of $5 million rescue bid |

| July 2, 2024 | Filing for Chapter 7 bankruptcy and ceasing operations |

| Post-bankruptcy | Eindhoven facility staff aims for independent restart |

Lessons Learned

Shapeways’ journey offers valuable lessons for businesses navigating financial distress. These insights can help companies better prepare for and manage similar situations.

Importance of Timely Financial Management

One of the critical takeaways from Shapeways’ story is the importance of timely financial management. Delays in financial reporting and resource allocation can exacerbate existing challenges and hinder strategic decision-making.

Evaluating Rescue Bids

When faced with financial difficulties, companies must carefully evaluate rescue bids and other funding options. Rejecting a rescue bid requires a clear, viable alternative plan to avoid further financial deterioration.

Employee Solidarity

The resilience and solidarity demonstrated by Shapeways’ Eindhoven facility staff underscore the value of a dedicated and cohesive team. Employee commitment can be a significant asset during times of crisis.

Conclusion

The story of Shapeways is a stark reminder of the complexities and challenges businesses face in times of financial distress. The company’s journey from rejecting a rescue bid to filing for bankruptcy highlights the critical importance of timely financial management, strategic evaluation, and the resilience of a committed workforce. As Shapeways’ Eindhoven facility staff looks to the future with renewed hope, their efforts serve as an inspiring testament to the power of determination and unity in the business world.

$30 off $400+ Anycubic Products with code AC30OFF